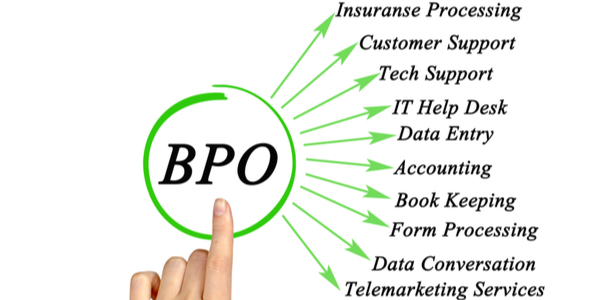

Business Process Outsourcing (BPO) involves businesses subcontracting a few of their work-related operations to third-party service providers. It was originally a tool for big-scale manufacturing companies to help with supply chain management. In the modern day, BPO is a full-fledged industry utilized by businesses all over the world. There are service-specific BPO providers who facilitate tasks for companies.

BPO – The Concept

BPO is essentially a strategized decision made by firms to divide labor, which helps them in times of unstable economy and saves cost. Insurance companies benefit a lot whilst outsourcing high-volume transactions, therefore leveraging BPO can be profitable. It can provide businesses with quick benefits whilst guaranteeing cost efficiency. BPO services can support a business’s hefty day-to-day services, which otherwise would have held the company down.

Why is Life Insurance and Annuities Industry in Need of BPO?

As previously mentioned, if utilized properly, BPO services can become a huge life saver and instant cost reducers for insurance companies. It is a rapid solution to a fast-growing problem in times of an economic downturn. It is essential for companies to implement quick cost reductions if they are looking to survive this challenging economic atmosphere. A trusted BPO provider with a good level of expertise can support a business in terms of customer retention, upsell and explore newer channels for sales, and provide a gateway worldwide.

What are Insurance BPO Services?

The ways in which insurance claims are handled often determine whether the insurer and the customer may continue to work in sync. It is, however, essential to make sure that the processing of claims takes place as quickly as possible while still considering the requirements and demands of the clients by having a specialized staff check the validity of each claim. This is done by insurance BPO service providers, who even reduce client attrition by selecting a reliable insurance BPO services provider.

Advantages BPO Provides to Life Insurance and Annuities Companies

Listed below are a few of the advantages of shifting to a BPO-based model:

Standardization of Business Processes

The uniform levels that are a result of consolidating company processes in an offshore manner to save costs are difficult to achieve via gradual steps. Through a standardized system, a business is in a good position to reach future processes to reach the desired level of efficiency through technology and quality.

Strategized Delivery System

The biggest obstacle to switching to a shared service is getting beyond the misunderstandings and anxieties about the performance, risk, and service level decrease. To ensure organizational longevity, procedures are essentially “wrenched out” of the business line, thereby deleting the barriers that inhibit consolidation and/or centralization.

Commercialized Operational Strategy

The cost of paying a bill, collecting a receivable, processing claims, or communicating with a client is many times something that businesses are unable to quantify. By leveraging insurance claims management services, companies are forced to think and decide differently when it comes to consumption and service levels. This includes cost benefits as well as customer satisfaction.

Entry into the Global Market

The degree to which economies and financial markets are increasingly linked and globalized is one of the key differences between the present economic crisis and previous recessions. Companies that do end up surviving, will be in dire need of adapting quickly to the international market while enabling their resources to focus on the competition. This means gaining the ability to instantly scale down procedures, which is provided by BPO. To offer BPO services, providers may instantly access talent pools throughout the world. This is extremely important in the life insurance sector.

Sales and Customer Retention

As previously mentioned, BPO service providers extensively help in customer retention and sales. Several consumers have been cutting down on coverage improvements and they are forgoing renewal rates insurance payments due to the widespread loss of employment. An extremely cost-effective way to approach consumers to offer different plans of life insurance and annuities is to use BPO services for sales and customer retention operations. A service provider that caters specifically to the insurance sector has deep knowledge of pitching the right services to specific customers. Outsourcing partners assist businesses to expand their sales through other channels such as banks or supermarkets.

Decreased Compliance Cost

It is quite expensive and time consuming to comply with fiduciary reporting requirements. The time and capital needed to comply with the strict rules that insurance companies must adhere to would be greatly reduced by BPO service providers, as they will be aware of all the nuances and compliance requirements.

Conclusion

The main purpose of BPOs is to cut costs, save time, and assess the main functionalities of a business or a company. A well-executed BPO model may opt for a commercialized operational strategy while retaining customers and promoting a global market entrance. All these processes are essential for growth and success, therefore, leveraging BPO services from an experienced provider is extremely crucial and beneficial.